Technology

The Future of Supply Chain Automation

The Future of Supply Chain Automation

As Amazon continues to set the bar for efficiency by integrating an astounding spectrum of automation technology, it’s becoming increasingly apparent that traditional supply chain models are ripe for disruption.

For this reason, companies around the world are now rethinking their warehouse and distribution systems, with automation taking center stage.

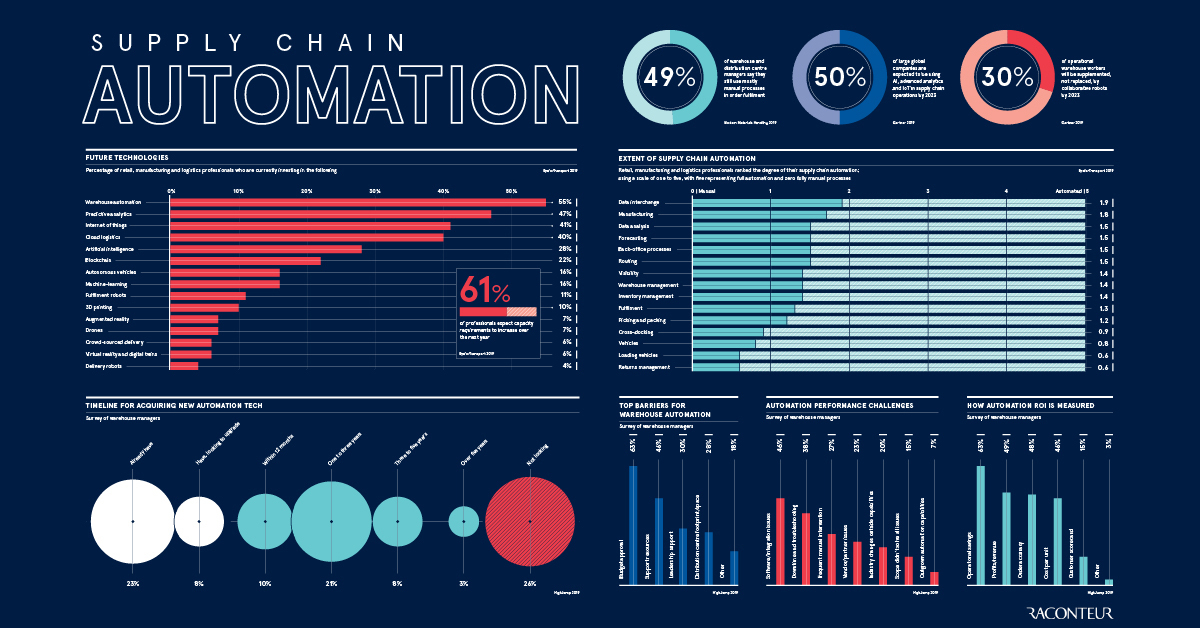

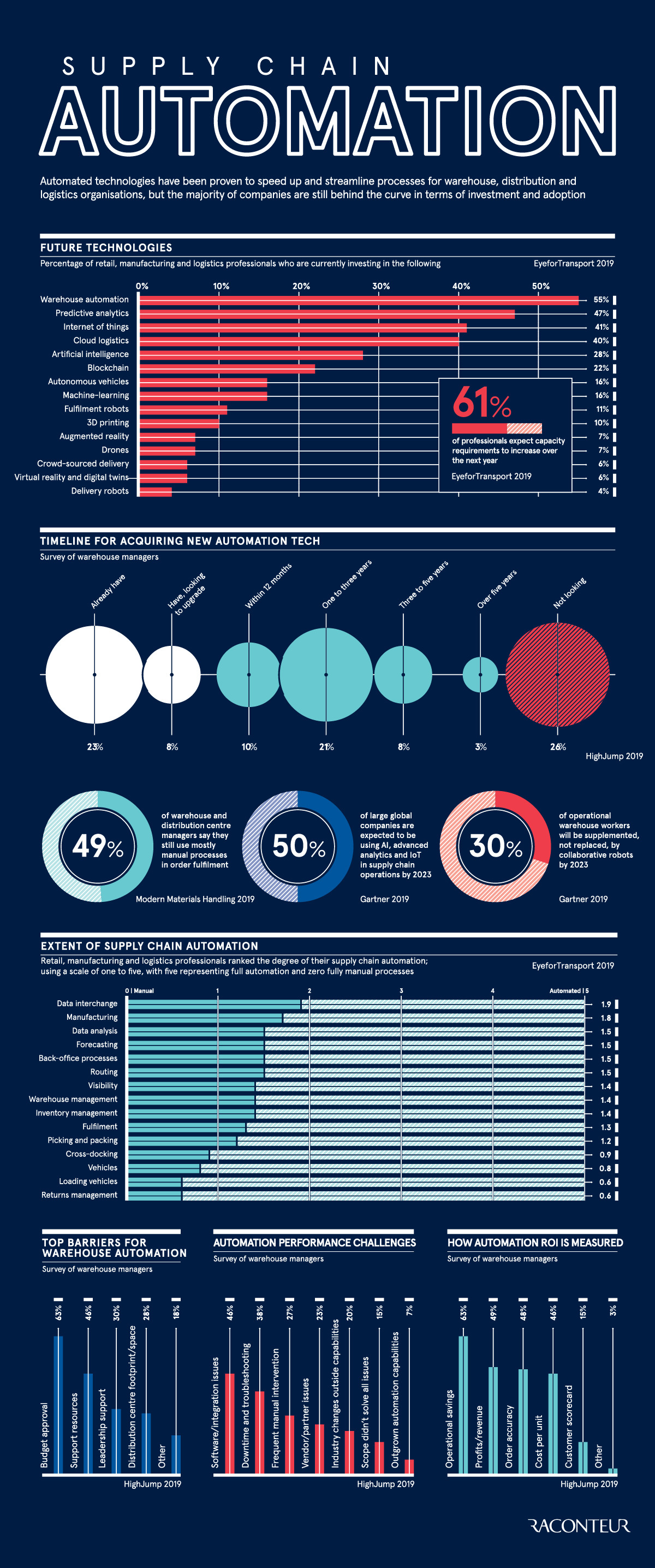

Today’s infographic from Raconteur highlights the state of automation across global supply chains, while also providing an outlook for future investment.

Long Time Coming

Let’s start by taking a look at what supply chain technologies are priorities for global industry investment in the first place:

| Rank | Technology | % of Companies* Investing in Tech |

|---|---|---|

| #1 | Warehouse automation | 55% |

| #2 | Predictive analytics | 47% |

| #3 | Internet of things | 41% |

| #4 | Cloud logistics | 40% |

| #5 | Artificial intelligence | 28% |

| #6 | Blockchain | 22% |

| #7 | Autonomous vehicles | 16% |

| #8 | Machine-learning | 16% |

| #9 | Fulfillment robots | 11% |

| #10 | 3D printing | 10% |

| #11 | Augmented reality | 7% |

| #12 | Drones | 7% |

| #13 | Crowd-sourced delivery | 6% |

| #14 | Virtual reality and digital twins | 6% |

| #15 | Delivery robots | 4% |

*Based on survey of supply chain professionals in retail, manufacturing, and logistics fields

As seen above, warehouse automation has already received more investment (55%) than any other supply chain technology on the list, as companies aim to cut delivery times and improve overall margins.

Interestingly, other areas receiving significant investment—such as predictive analytics, internet of things, or artificial intelligence—are technologies that could integrate well into the optimization of supply chain automation as well.

Smoothing the Transition

While fully automated supply chains in most industries may still be a few years away, here is how companies are investing in an automated future today:

| Timeline For Acquiring New Automation Tech | % of Warehouse Managers Surveyed |

|---|---|

| Already have | 23% |

| Have, looking to upgrade | 8% |

| Within 12 months | 10% |

| One to three years | 21% |

| Three to five years | 8% |

| Over five years | 3% |

| Not looking | 26% |

According to the above data, over 70% have already integrated automation technology, or are planning to within the next five years. On the flip side, over a quarter of warehouse managers are not currently looking to integrate any new automation tech into their operations at all.

Adoption Rates and Growth

As supply chain automation gains momentum and industry acceptance, individual processes will have varying adoption rates.

Take order fulfillment, for instance. Here, only 4% of current operations are highly automated according to a recent survey from Peerless Research Group:

| Order Fulfillment Operations (Picking and Packaging) | Percentage of Respondents |

|---|---|

| Highly automated | 4% |

| A mix of automated and manual processes | 42% |

| Mostly or all manual | 49% |

| Not applicable | 5% |

Meanwhile, 49% of operations were primarily manual, illustrating potential for growth in this particular area.

It’s worth noting that other individual supply chain components, such as conveyor belts, storage, automated guided vehicles, and shuttle systems, will all have differing trajectories for automation and growth.

Post-COVID Supply Chains

The COVID-19 pandemic has shown us that complex supply chains can become fragile under the right circumstances.

As supply chains see increased rates of automation and data collection becomes more integrated into these processes, it’s possible that future risks embedded in these systems could be mitigated.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024