US ETF inflows surge past $500bn this year to eclipse 2020 record

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Investors have ploughed half a trillion dollars into US exchange traded funds in less than eight months, eclipsing last year’s record haul in the latest sign of how booming markets have sparked a rush into the low-cost vehicles.

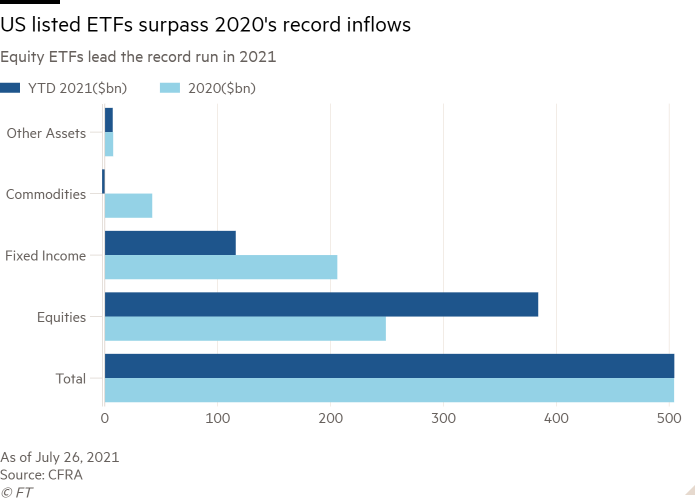

Net inflows into US listed ETFs are running at $505bn so far this year, topping the total for 2020 by $1bn, according to CFRA, a data and research service. Total US ETF assets under management have hit $6.6tn.

A relentless rally this year in share markets, which has brought major US indices ever further into record territory, has sent investors racing towards ETFs that track Wall Street and international equities. US-listed stock ETFs have attracted $384bn of new money so far this year, well ahead of the $249bn posted for all of last year.

Some analysts are now pencilling in global 2021 ETF inflows of as much as $1tn, something that has bolstered the hopes of some industry participants that global assets under management will reach $15tn by the middle of this decade, up from its current level of $9tn.

“While the pace of flows might slow down if market volatility increases in the third quarter, we think a $1tn cash haul in 2021 is conceivable,” said Todd Rosenbluth, head of ETF and mutual fund research at CFRA.

Debbie Fuhr, founder of ETFGI, a consultancy, said the strong inflows showed “there is a growing preference for ETFs, especially in the US where there are benefits to the ETF wrapper”.

The industry has been boosted as financial advisers increasingly use the vehicles as part of managing and diversifying their clients’ portfolios. New funds that are designed to mimic popular investment themes, such as those seeking to take into account environmental, social and corporate governance standards, have also attracted significant amounts of new money this year. In addition, ETFs have lower costs and are a more efficient tax structure as they generate fewer capital gains tax bills for investors than mutual funds.

While these are favourable tailwinds, the broad performance of markets will determine whether the current pace of inflows is sustained in the coming months, analysts caution. “The trajectory of the market can impact investor sentiment and looking at flows during July, there is a sign of some concern,” said Matthew Bartolini, head of SPDR Americas research at State Street Global Advisors.

Equity sector inflows were running at $2bn so far this month, compared with a recent average pace of $9bn, with investors taking a more defensive stance, preferring healthcare, consumer staples and quality over financials, cyclicals and energy, said Bartolini.

Although demand for ETF exposure had been very strong during the past 12 months, a conservative forecast for this year would be $720bn, should flows ease and return to their average pace of the past three years, Bartolini added.

After a tepid pace earlier this year, flows into fixed income ETFs are running at $116bn and are on track to meet 2020’s record of $206bn, said CFRA. Commodity-focused ETFs have posted inflows of $40bn.

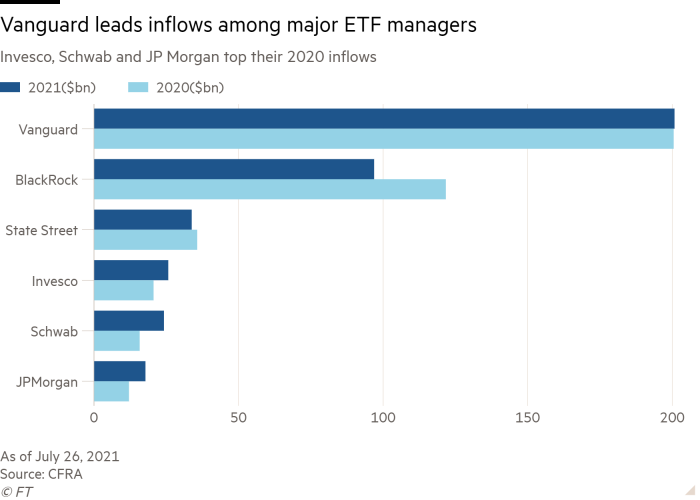

Among the major ETF providers, Vanguard has led the way, attracting $200bn of new money, matching its entire total for last year. BlackRock, the dominant player, has garnered $100bn of inflows, just shy of 2020’s $122bn, while Invesco, Schwab and JPMorgan are running ahead of last year’s totals, according to CFRA.

Additional reporting by Emma Boyde

Click here to visit the ETF Hub

Comments